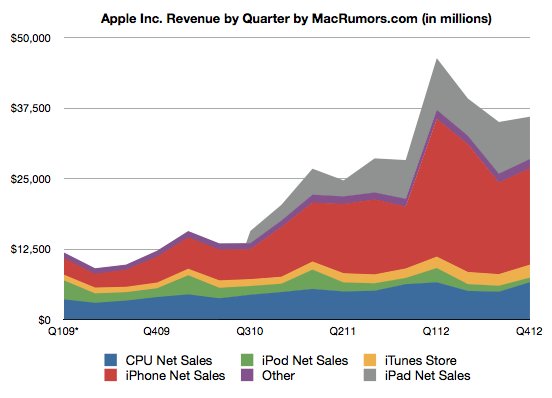

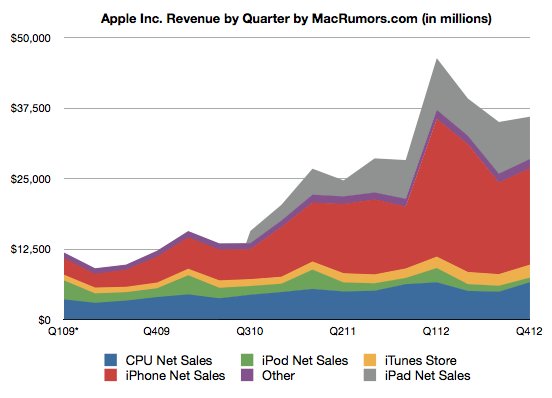

Apple today announced financial results for the third calendar quarter and fourth fiscal quarter of 2012. For the quarter, Apple posted revenue of $36.0 billion and net quarterly profit of $8.2 billion, or $8.67 per diluted share, compared to revenue of $28.27 billion and net quarterly profit of $6.62 billion, or $7.05 per diluted share, in the year-ago quarter. Apple had provided guidance for this quarter of $34 billion in revenue and earnings of $7.65 per share.

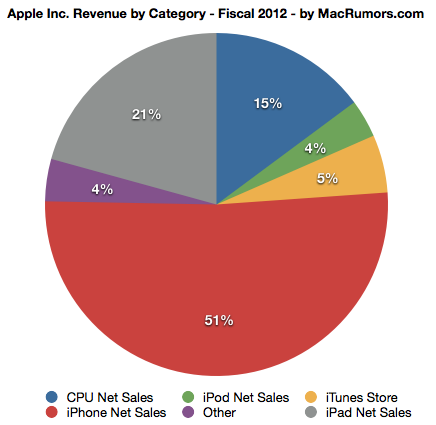

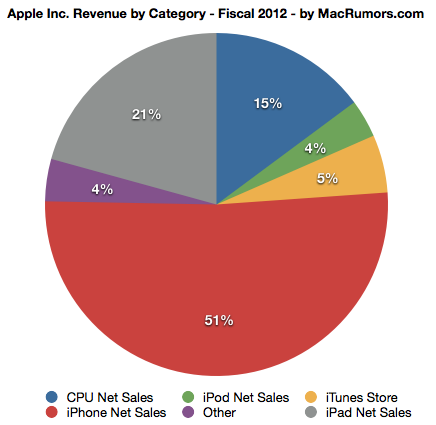

Apple reported total revenue of $156.5 billion and net profit of $41.7 billion for fiscal 2012, both company records. In fiscal 2011, Apple earned $25.9 billion on $108.2 billion in sales.

Gross margin for the quarter was 40.0 percent, compared to 40.3 percent in the year-ago quarter, and international sales accounted for 60 percent of revenue. Apple's quarterly profit and revenue were both company records for the September quarter. Apple also declared another dividend payment of $2.65 per share payable on November 15 to shareholders as of the close of trading on November 12. The company now had $124.25 billion in cash and marketable securities.

Quarterly iPhone unit sales reached 26.9 million, up 58 percent from the year-ago quarter, and the company sold 14.0 million iPads, up 26 percent year-over-year. Apple sold 4.9 million Macintosh computers, a unit increase of 1 percent over the year-ago quarter, as well as 5.3 million iPods, representing a 19 percent unit decline year-over-year.

Apple will provide live streaming of its Q4 2012 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Earnings Call Highlights

- New September quarter records for iPhone, iPad and Mac unit sales. Highest Sept quarter revenue and profit ever.

- Sold 4.9 million Macs, 1% growth year over year compared to IDC estimates of 8% contraction of global computer market.

- Portables make up 80% of Mac unit mix, highest ever.

- 3-4 weeks of Mac channel inventory, off from 4-5 weeks of preferred.

- iPod Touch accounts for more than half of iPods sold.

- iPod share is 70%+ of market, still top mp3 player in most countries.

- iTunes Store produced record results of $2.1 billion.

- New iTunes launching soon.

- 58% year over year growth of iPhones, versus 35% for smartphone market over the quarter.

- Demand for iPhone 5 continues to outstrip supply.

- 9.1 million iPhones in channel inventory, up 800k from last week. Below target 4-6 weeks of iPhone channel inventory.

- Touting how Canon and Amtrak use the iPhone, as well as reporters from BBC, CTV and the Wall Street Journal.

- iPad sales were ahead of Apple's internal expectations. Strong year over year growth across all geographies.

- Talking about enterprise companies using iPad including Volkswagen (more than 30 internal iPad apps).

- Sold 44 million iOS devices in September quarter.

- New quarterly record for app sales.

- Made a number of improvements to Maps in the past month, won't stop improving.

- $4.2 billion for Retail stores. Up 18% year over year. Store's best iPhone launch ever. New quarterly record for Mac sales, moving 1.1 million Macs. 18 new stores in 10 countries including 1st store in Sweden. 390 stores total. 94 million visitors vs 77.5 million last year. 19,000 visitors per store per week.

- Tax rate of 25.2% for fiscal 2012.

- Cash of $121.3 billion at end of the quarter, up $4 billion from prior quarter.

- Paid $2.5 billion in cash dividend in August.

- $2.65 / share dividend comes out in November.

- Entered share repurchase program, may also repurchase shares in open market share transactions.

- Strongest product pipeline ever.

Apple reported total revenue of $156.5 billion and net profit of $41.7 billion for fiscal 2012, both company records. In fiscal 2011, Apple earned $25.9 billion on $108.2 billion in sales.

Gross margin for the quarter was 40.0 percent, compared to 40.3 percent in the year-ago quarter, and international sales accounted for 60 percent of revenue. Apple's quarterly profit and revenue were both company records for the September quarter. Apple also declared another dividend payment of $2.65 per share payable on November 15 to shareholders as of the close of trading on November 12. The company now had $124.25 billion in cash and marketable securities.

Quarterly iPhone unit sales reached 26.9 million, up 58 percent from the year-ago quarter, and the company sold 14.0 million iPads, up 26 percent year-over-year. Apple sold 4.9 million Macintosh computers, a unit increase of 1 percent over the year-ago quarter, as well as 5.3 million iPods, representing a 19 percent unit decline year-over-year.

“We’re very proud to end a fantastic fiscal year with record September quarter results,” said Tim Cook, Apple’s CEO. “We’re entering this holiday season with the best iPhone, iPad, Mac and iPod products ever, and we remain very confident in our new product pipeline.”

Apple's guidance for the first quarter of fiscal 2013 includes expected revenue of $52 billion and earnings per diluted share of $11.75.

Apple will provide live streaming of its Q4 2012 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Earnings Call Highlights

- New September quarter records for iPhone, iPad and Mac unit sales. Highest Sept quarter revenue and profit ever.

- Sold 4.9 million Macs, 1% growth year over year compared to IDC estimates of 8% contraction of global computer market.

- Portables make up 80% of Mac unit mix, highest ever.

- 3-4 weeks of Mac channel inventory, off from 4-5 weeks of preferred.

- iPod Touch accounts for more than half of iPods sold.

- iPod share is 70%+ of market, still top mp3 player in most countries.

- iTunes Store produced record results of $2.1 billion.

- New iTunes launching soon.

- 58% year over year growth of iPhones, versus 35% for smartphone market over the quarter.

- Demand for iPhone 5 continues to outstrip supply.

- 9.1 million iPhones in channel inventory, up 800k from last week. Below target 4-6 weeks of iPhone channel inventory.

- Touting how Canon and Amtrak use the iPhone, as well as reporters from BBC, CTV and the Wall Street Journal.

- iPad sales were ahead of Apple's internal expectations. Strong year over year growth across all geographies.

- Talking about enterprise companies using iPad including Volkswagen (more than 30 internal iPad apps).

- Sold 44 million iOS devices in September quarter.

- New quarterly record for app sales.

- Made a number of improvements to Maps in the past month, won't stop improving.

- $4.2 billion for Retail stores. Up 18% year over year. Store's best iPhone launch ever. New quarterly record for Mac sales, moving 1.1 million Macs. 18 new stores in 10 countries including 1st store in Sweden. 390 stores total. 94 million visitors vs 77.5 million last year. 19,000 visitors per store per week.

- Tax rate of 25.2% for fiscal 2012.

- Cash of $121.3 billion at end of the quarter, up $4 billion from prior quarter.

- Paid $2.5 billion in cash dividend in August.

- $2.65 / share dividend comes out in November.

- Entered share repurchase program, may also repurchase shares in open market share transactions.

- Strongest product pipeline ever.